Summary of Ferd’s financial results for 2022

2022 was characterized by the outbreak of war in Ukraine, escalating energy prices, rising inflation and volatile global stock markets. This also led to a fall in value for several of Ferd’s listed investments in the first half of the year. For some of the investments that fell more than indicated by the underlying earnings, Ferd used the opportunity to increase its exposures to the companies. The second half of 2022 was more stable, and several investments recovered some of the value decline from the first half of the year. Elopak, which is Ferd’s largest listed investment, rose 54 per cent in value in the second half of the year and ended up with a full-year value decline of 4.5 per cent.

Ferd’s value-adjusted equity at the end of 2022 has been calculated to be NOK 43.0 billion (NOK 48.0 billion on 31 December 2021). The return on value-adjusted equity for Ferd was minus 9.1 per cent in 2022. The return expressed in NOK, after adjusting for dividend payments to the company’s owners, was minus NOK 4.4 billion.

The return on Ferd Capital’s combined portfolio was minus 9.7 per cent for 2022. The combined return of the private companies was positive, but the listed portfolio had a negative return. The return for Ferd’s real estate portfolio was minus 9.1 per cent, as a result of yield increase, higher construction costs and a weaker value development in the residential market. Ferd External Managers reported an aggregate return of minus 15.3 per cent (in USD terms) for their investment mandates. Measured in NOK, the return was better (minus 5.3 per cent) as a result of the weakened krone against the USD in 2022.

In 2022, Ferd invested a total of NOK 6.4 billion and received a total of NOK 6.2 billion from realisations and dividends. Within Ferd Capital’s privately owned investments, Aidian represented the largest new investment during the year. A total of NOK 2.8 billion was invested in the listed portfolio, of which investments in BHG Group, Lerøy Seafood and Boozt were the three largest. In total, Ferd received NOK 1.2 billion in dividends from Ferd Capital’s investments last year. Ferd liquidated Ferd Invest in the first half of the year, which freed up NOK 2.8 billion in cash.

At the end of 2022, Ferd’s net liquidity holdings totalled NOK 1.0 billion. The value of Ferd’s listed shares, equity funds and liquid hedge fund investments was NOK 15.5 billion at 31 December 2022. In total, the value of Ferd’s liquidity holdings and liquid investments was NOK 16.5 billion at 31 December 2022 and represented 38 per cent of value adjusted equity. Ferd also had undrawn credit facilities of NOK 6.7 billion.

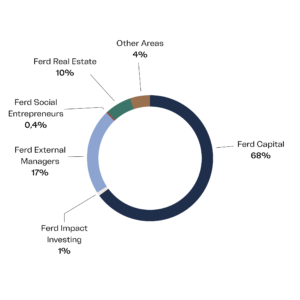

Composition of Ferd’s value-adjusted equity at 31 December 2022:

Ferd Capital

Ferd Capital is a long-term, flexible and value-adding partner for Nordic companies.

The business area has two investment mandates: Private companies and Listed companies. These mandates give the business area flexibility in terms of the types of investments it can make. Ferd Capital’s portfolio of privately owned companies at 31 December 2022 consisted of Aibel, Aidian, Brav, Broodstock, Fjord Line, Fürst, Interwell, Mestergruppen, Mnemonic, Norkart, Simployer and Try. The largest listed investments were Benchmark Holdings, Boozt, BHG, Elopak, Lerøy and Nilfisk.

The combined return on Ferd Capital’s portfolios was minus 9.7 per cent in 2022. Aibel and Interwell had the largest positive contributions of the private companies, while Mestergruppen and Brav fell in value as a result of tougher market conditions than in recent years. The portfolio of listed investments ended down by 27 per cent for the year.

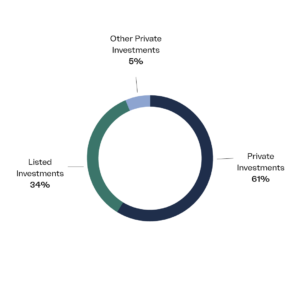

Ferd Capital’s portfolios were valued at NOK 29.2 billion as of 31 December 2022. The value was allocated between the two mandates and other investments as follows:

Ferd Real Estate

Ferd Real Estate is a responsible and long-term urban developer. With thoroughness, innovative thinking and a great commitment to sustainability, they create value beyond financial returns.

Ferd Real Estate’s return ended at minus NOK 415 million for 2022, corresponding to minus 9.1 percent. Residential real estate prices in Oslo rose by 1.8 per cent in 2022, while the yield for commercial properties in central Oslo (the CBD area) increased significantly after the increase in in interest rates last year. The decline in values for Ferd Real Estate’s commercial properties was mainly due to increased yield and higher construction costs. For the Marienlyst project and one of the logistics properties, the return was good in 2022, while for the other residential projects the return was weaker primarily due to higher expected construction costs.

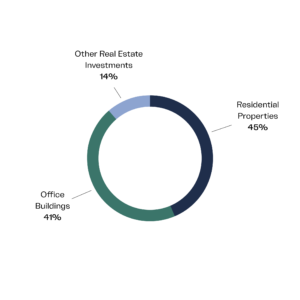

At the end of 2022, Ferd Real Estate’s portfolio had a property value of NOK 12.2 billion and an equity value of NOK 4.1 billion. As of 31 December 2022, the real estate portfolio was divided between the market segments as follows:

Ferd External Managers

Ferd External Managers is responsible for the group’s investments with external managers. The business area focuses on markets that complement the areas where Ferd invests directly, and it invests in funds that will provide attractive returns over time.

Ferd External Manager’s portfolios had a total return of minus 15.3 per cent in 2022. The portfolios are measured and followed up in US dollars. Measured in NOK, the return was better (minus 5.2 per cent) as a result of the weakened krone against the USD in 2022. The Global Equity mandate, which is made up solely of equity funds, had a return of minus 22.6 per cent, which is 2.3 per cent weaker than the benchmark for this mandate. The Global Fund Opportunities mandate had a return of 4.9 per cent measured in USD.

During spring 2022, NOK 500 million was allocated to the Global Equity mandate. The market value of Ferd External Manager’s portfolios as of 31 December 2022 was NOK 7.3 billion.

Allocation of the Ferd External Managers portfolio between investment mandates on 31 December 2022:

Ferd Impact Investing

Ferd Impact Investing invests in early-phase companies with the potential both to have a positive impact in terms of the UN’s Sustainable Development Goals and to generate a robust risk-adjusted return. Ferd Impact Investing primarily invests through funds, but also makes some direct investments in individual companies. It concentrates on three sectors, namely renewable energy, real estate technology and aquaculture.

Ferd Impact Investing was established in 2019 and has so far made 15 investments. In 2022, investments were made in two new funds (ArcTern Ventures and SWEN Blue Ocean), as well as three new co-investments (Nofence, Shoreline and 360 Logistics) and three follow-up investments (Seagust, Wind Catching Systems and Ignite Procurement).

In 2022, Ferd Impact launched its first Impact Report, which gives an insight into how they work with impact and how the portfolio contributes to solving challenges related to the climate and the environment.

As of 31 December 2022, Ferd Impact Investing had invested NOK 389 million and committed a further NOK 70 million.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs that deliver good social and financial results, and it improves their chances of success through a combination of capital, expertise, and networking. FSE also collaborates with the public sector to create the tools and frameworks it needs to collaborate with these innovative entrepreneurs.

At the end of 2022, FSE’s portfolio included 12 social entrepreneurs (10 companies and two fund investments). During the year, FSE made two new investments. The first company, Ludenso, is a technology company that through the use of AR-enriched (Augmented Reality) schoolbooks, will provide increased engagement, sense of achievement and a customized learning journey for students. The second company, Lifetools Know Me, develops digital communication tools that help people who do not have the ability to verbal speech to be understood.

In 2022, FSE has followed up the three social impact contracts they have invested in. In a social impact contract, a private sector investor finances a measure that has a predetermined objective, and the investment is repaid by the public sector if this objective is achieved. The public authorities only make payment if the agreed results are achieved, and investors only recover their investment if society benefits from the results of the investment.

In 2022, FSE also launched its “Oslo initiative”. In the Oslo initiative, they bring together business and foundations for a joint effort for the more socially vulnerable areas in Oslo.

Other Activities

Other Activities principally comprises bank deposits and money market funds, as well as investments in funds purchased in the secondary market and investments in externally managed private equity funds.

The Norwegian krone weakened against EUR and USD and strengthened against SEK in 2022. If translation differences caused by changes in exchange rates were excluded, Ferd’s combined return in 2022 would have been approximately 2.1 percentage points lower.